Re: A news item and subject which I just want to check out (120) January 12, 2024

12 days have passed since the Noto Peninsula Earthquake that blew away the New Year’s mood occurred right at the start of the New Year. It caused a major disaster with 213 deaths and 37 safety unknown persons as of today. And isolated settlements difficult to transport people and goods are still 22 districts in 2 cities and 1 town in total and there are 3,124 persons. About 26,000 persons are living in 398 evacuation centers established in 13 cities and towns now. And in addition to severe cold with rain and snow, it is said that water outrages are still in about 59,000 households and blackouts are in about 15,000 households. I hope for a speedy recovery and I would like to express my deepest sympathy.

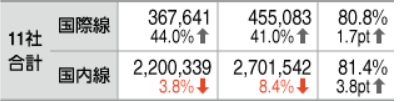

By the way, the service industry has recently emerged from a long tunnel and is getting back in condition. The occupancy rate of hotels has risen to about 80 % with the increase of inbound visitors and established the highest level in November following the previous month in 2023 since the corona disaster. Room unit price has also increased by about 4 %.

On the other hand, the number of passengers carried via domestic air transportation at the end of the year and the beginning of the New Year from December 28 to January 3 decreased by 4 % compared with the corresponding period of a year earlier due to the influence of the accident at Haneda Airport. As far as an international flight is concerned, it was 367,000 increased by 44 % compared with the corresponding period of a year earlier, but it seems that it was less than 70 % compared with the corresponding period of 2019 before the corona disaster. It seems to me that it is affected by a weaker yen.

■■What I have thought and focused on recently:

■This year is an unprecedented election year:

As I mentioned in the blog in December, this year is the biggest election year in history with more than 70 important elections in the world. I feel like future generations will call this year as “that year was a turning point in history”.

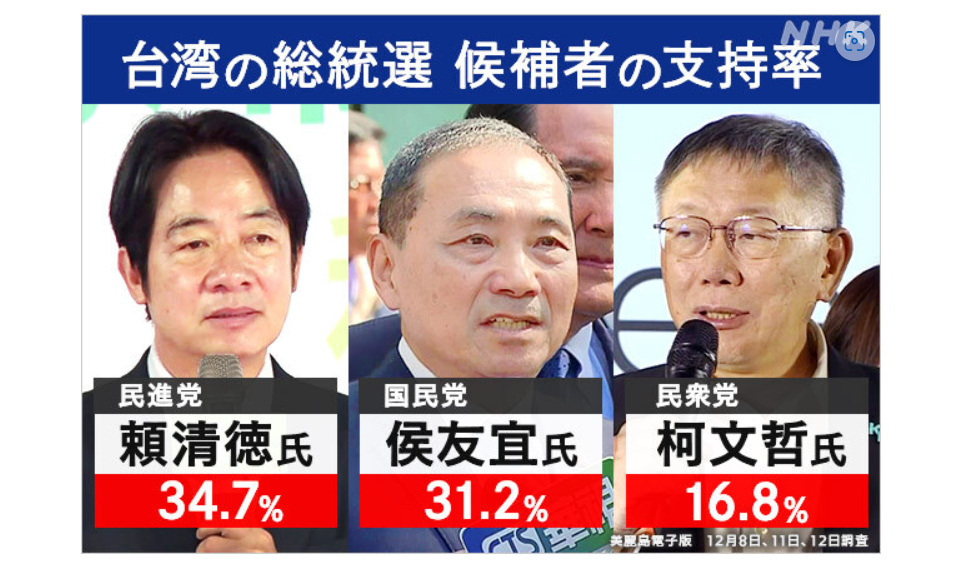

Among the many elections, elections which will have a significant impact on the future of Japan are presidential election in Taiwan held on January 13 and presidential election in the United States on November 5.

In presidential election in Taiwan, Mr. Lai Ching-te of Democratic Progressing Patry that puts emphasis on independence and relations with the United States and Mr. Hoh Yu-ih of Chinese National Party that aims for reconciliation with China are competing fiercely, and the result is highly unpredictable. If Democratic Progressing Party wins, China will strengthen military pressure furthermore. On the other hand, if Chinese National Party wins, I think that China will take a conciliatory measure instead of a hardline measure.

And if Mr. Trump takes back his old position in presidential election in the United States, the world situation will change dramatically, not only in Japan. Preliminary election that decides presidential candidate of the Republican Party will start in Iowa Caucus at full scale on January 15 (Monday), and it will be decided by Republican National Convention from July 15 (Monday) to 18 (Thursday). My biggest concern in this election is whether Anti-Trump faction will unite behind Mrs. Haley, former ambassador to the United Nations, or not.

On the other hand, in the Democratic Party, there seems to be no candidate other than President Biden.

Outside Taiwan and the United States, the following elections will be held this year. Presidential election in Indonesia (February 14), presidential election in Russia (March 17), general election in Korea (April 10), general election in India (will be held before May), presidential election in Mexico (June 2), and election to the European Parliament (June 6 ~9). Each election has a significant meaning.

■The top 10 risks for 2024:

Eurasia Group known as political risk specialized consulting company publishes the top 10 risks of the year at the beginning of every year. According to this, No.1 of the year is “dividing into parts in the United States”, No.2 “the Middle East in a critical moment”, No.3 “a virtual cession of Ukraine”, No.4 “a lack of AI governance”, No.5 “axis powers of rogue nations” and No.6 “China where the economy can’t recover”. These are very common sense and agreeable points.

Incidentally, No.1 last year was “rogue nation Russia” and No.2 was “absolute power Xi Jinping”. The world situation has changed dramatically over the past year, and new IT such as “Chat GPT” (launched in November 2022) has appeared. The top 10 risks for 2024 symbolize the world situation that has become increasingly complex and enhanced the sense of uncertainty over the past year.

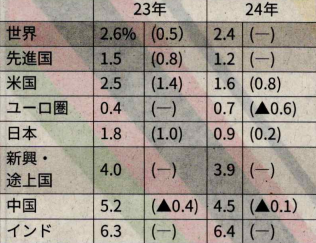

■Global economic outlook of the year:

The World Bank published an outlook of the global economic growth rate on January 9. According to this, it will be plus 2.4 % in 2024 down from plus 2.6% in 2023 and expected to slow down for 3 consecutive years. It says that interest rates that correspond to persistent inflationary pressures will push down demand. In particular, the growth rate in China is revised down to 5.2 % in 2023 and 4.5 % in 2024, reflecting the decline in real estate market and so on. And it seems that a military-targeted fight for “anti-corruption” is also continuing.

Reflecting such sluggish Chinese economy, the growth rate of world trade will remain 2.4 % in 2024. And the price of crude oil has also continued to decline in spite of coordinated production cut by oil-producing countries, OPEC plus. However, “carelessness is the great enemy”, because the price of crude oil is greatly influenced by the situation in the Middle East.

■The trend of Japanese economy:

The Nikkei stock average has reached the 35,000-yen mark at one time and hit a new 34-year high. Some people expect it will exceed the highest price of the bubble economy, 38,915 yen on December 29, 1989. The following can be considered as a cause. 1)The business performance is doing well, benefiting from a weaker yen. 2) The net purchase by foreign investors 3) New NISA started on January 1, and money is flowing into the stock market because of encouraging money to flow “from savings to investments”. In particular, it seems that foreign investors took that Japanese corporate executives have shifted to a stock price-conscious management following the guidelines launched by the Tokyo Stock Exchange called “increase PBR, Price Book-value Ratio, to 1 or more”. However, foreign investors put emphasis on short-term buying and selling, and then it is also a factor in violent fluctuations.

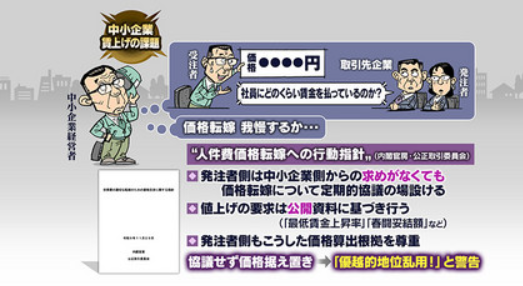

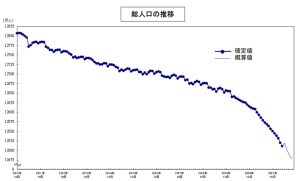

On the other hand, as far as real economy is concerned, real wages in November last year were minus for 20 consecutive months and consumer spending was also minus for 9 consecutive months. A full-scale economic recovery in the future depends on an exchange rate and a trend of a wage increase. It is expected that large companies will give more than 5 % wage increase in the spring labor offensive against the background of strong performance. But the problem is a wage increase for small and medium-sized enterprises, 99.7 % of all companies in Japan which are considered to be about 3.7 million, that account for about 70 % of total employed population and are in a severe financial condition called that more than 60 % of them have not paid their corporate taxes.