Re: A news item and subject which I just want to check out (125) February 16, 2024

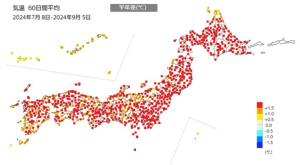

Warm days are continuing this week. Japan Meteorological Corporation headquartered in Osaka announced a forecast of the start of cherry blossoms and timing of cherry blossoms in full bloom for the fourth time in 2024 yesterday. It predicts that cherry blossoms across the country will bloom either on schedule or slightly earlier than usual and the cherry blossoms are expected to bloom in Tokyo in March 23 and in Osaka in March 25.

By the way, when warm days continue and we drink a drink in a Japanese bar and so on, we tend to “start off with a beer”. It seems to me that there is no product as familiar and topical as beer. As a matter of course, interest in price trends, sales and new products is high. Sales volume of the four major companies, which are Asahi, Kirin, Suntory and Sapporo, in 2023 increased by 7 % compared to the previous year. It is said that in addition to the tailwind provided by the beer tax reduction of the liquor tax reform in last October, the recovery of business use contributed to it, because the corona disaster restrictions have been eased. But it seems that beer/beer-like beverages in whole decreased by 1 %, because sales volume of the third-category beer deceased by 15 % due to tax hike.

On the other hand, in the United States, beer consumption in 2023 suddenly decreased by 5.2 % compared to the previous year and was the lowest level in 24 years. It seems that in addition to the diversification of choices such as low alcohol soda water “Hard Seltzer”, a background is sobriety tendency spreading with the younger generation at the center. And it also affects that the rate of price increase related to alcoholic beverages during dining out has been large over the past 20 years.

■■What I have recently thought and focused on:

■Japanese-style management seen from overseas managers, especially Asian managers:

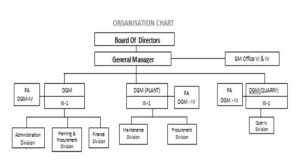

There were comments on Japanese companies by prominent managers in Asia who are very knowledgeable about Japan in a recent newspaper. There are differences in national traits and industries, but I would like to list them as follows, because they clearly pointed out the strengths and weakness of Japanese companies.

1) Chairman Ho of Banyan Tree Holdings, leading resort company, in Singapore

What he pointed out are ①the importance of developing transportation infrastructure from a foreigner’s point of view, especially improving accessibility of undeveloped rural areas ②there are fewer English speakers and AI should be used ③the importance of labor shortage measures and turning the rudder to immigration acceptance policies

2) CEO C.C, Wei of TSMC, semiconductor manufacture, in Taiwan

The said company is known as top-down management which is common in Taiwan. It has constructed 10 state-of-the-art factories at overwhelming speed in Taiwan for several years, and strengthened its position in the industry. In Arizona, the United States, where it had decided the construction earlier than in Japan, there was a problem in securing workers and the planned start of operation in December 2022 is expected to be delayed by more than one year. In contrast, regarding steady progress of Kumamoto factory, he “expresses his heartfelt gratitude for the outstanding contributions of those involved in Japan”.

3) Chairman Boonsithi of Saha Group, financial combine in Thailand, who is called as the king of consumer goods

It is said that the said financial combine has about 80 joint ventures with Japanese companies. He points out that Japanese companies “tend to build long-term trust relationships”, but their business operations “follow the traditional step-by-step” and they think too slowly and then “they can’t keep up with today’s world where the speed of innovation is fast”.

4) Chairman Bhargava of Maruti Suzuki in India, which is a consolidated subsidiary of Suzuki in Japan

It is said that the said company is “the biggest success example of Japanese company that has expanded into India”. In regard to this, he says that success factor is that “if you come to India, don’t follow how to do things in India”. His fundamental principle of labor policy is that “laborers and employers are partners”, according to Japanese way, and he has promoted a culture of equal work without a class system like Caste rooted in India. India has an abundant workforce of high-level human resources, but many people struggle with poverty and equality remains far from reach.

As mentioned above, what is cited as weakness of Japanese companies is that they are “slow to come to a decision”. This issue had also been pointed out by American executives. It seems to me that there are undercurrents of “side-by-side and following precedent” and “when everybody is crossing on the red light, it is not so scary”. In other words, they are “hesitant or cautious to take risks” on their own initiative. In response to this, I explain that “Japanese companies take time for decisions due to valuing consensus, but once they have decided, they will absolutely move into execution”. But this point is perceived as that “they can’t adapt to rapid environment changes”.

The strengths of Japanese companies are that “they build trust from a long-term perspective, rather than a short-term one” and “if it is decided, they do it properly and keep it”. In any case, to prepare for promoting overseas expansion and joint ventures, it is essential to study and understand properly the national situation and market of the country you want to expand into and nationality of the joint venture partner, and personnel development and placement are also necessary from the perspective of the right person in the right place.

■A wage increase and price pass-through:

Annual wage negotiations between management and labor unions which can make or break whether Japanese economy will be on a full-fledged growth trajectory have started. The focus is whether we can escape from the current situation where real wages have decreased for two consecutive years. Leading companies are establishing wage increase policies in accordance with national policy to some extent. However, the issue is trends of small and medium-sized enterprises that account for 99.7 % of all companies in Japan more than 3 million and employ about 70 % of total employed population. And the key factor here is whether they can pass on both the cost increase of raw materials and so on and funds needed for wage increases to the price.

Incidentally, according to a recent survey related to road freight transport industry I used to work in conducted by the Japan Fair Trade Commission and the Small and Medium Enterprise Agency, in response to the question “regarding the transaction price, are you able to pass on cost increases?”, 45.5 % of those on the ordering parties answered “generally accepted”. On the contrary, the answer of the receiving parties that “can pass on the price” was only 21.3 %.

Regarding business environment of trucking industry, since the implementation of deregulation by two laws on logistics some 30 years ago, total domestic cargo volume has decreased by about 30 %, due to the change of domestic and international economic situation and industrial structure and the influence of declining birthrate and aging population and falling population. On the other hand, the number of truckers has increased by 50 % and now about 62,000 companies exist in Japan. It is a typical conglomeration of small and medium-sized enterprises where 55 % have 10 or less vehicles and nearly half of the companies have fewer than 10 employees. And most of them don’t have the sales ability to collect cargo on their own, and are under multi-layer structure such as subcontractors and sub-subcontractors of major companies. Therefore, the ability to negotiate transportation terms including shipping charge is extremely weak and it is no exaggeration to say that they are in a state of subjugation. And in order to cover cheap shipping charge, compliance awareness also tends to be lacking in reality. In the current situation, securing talent is extremely challenging, let alone wage increases, investment to DX and assets necessary for future business continuity. On top of that, due to “2024 problem”, a regulation on the total number of overtime work hours, successor difficulties, repayment of zero-zero loan and so on, an increase in bankruptcies, business closures, and job transitions is anticipated in the future, and there are growing concerns about ensuring transportation capacity.

By the way, it is said that the government will submit “the Logistics Comprehensive Efficiency Act” that puts emphasis on shipper’s measures and improving logistics productivity, in order to correspond to “2024 problem”. On the other hand, under liberal market economy, “the price of an item” other than the official fee is determined by supply and demand. “Leftovers have no value” is common sense of economics. In order to correct the current oversupply regime or excessive competition and aim for “proper freight”, “structural reform”, reorganizing and integrating business operators to a certain size, is essential. Otherwise, I think that sound development of trucking industry responsible for more than 90 % of domestic transport in Japan is not expected.