Re: Recent topics (Coronavirus, Ukraine and Inflation) February 18, 2022

There are two more days left in Beijing Winter Olympics where exciting games have taken place every day (The Olympics will end on February 20). I have been impressed by sweats and tears of athletes, and at the same time I have felt severeness and cruelty in the sporting field. And the Paralympics will be held for ten days from March 4.

By the way, there are three recent big topics.

①New coronavirus which continues to rage globally

②Confrontation between Western Countries and Russia over Ukraine

③Inflation which becomes remarkable worldwide

The following are my comments regarding these topics.

①New coronavirus

Omicron variant confirmed in November last year has continued to rage, and total number of people infected exceeded 0.4 billion (about 5% of world population). 0.1 billion have increased only in one month, and the number of the dead was over 5.8million. Meanwhile, in Japan total number of people infected is 4 million, and the number of the dead is over twenty thousand. However, it seems to me that ‘With Corona’ is becoming established both globally and domestically, and an influence on economy will reduce gradually in future, due to lower risk of serious condition even though higher infectivity than conventional variant, developing methods of emergency treatment, and third time vaccination starting in earnest very soon.

But, considering the present situation in which sickbeds are tight because of rapid increase of infected persons and half million people’s recuperation at home, and anxiety in case of infection, we have to take all possible measures to protect against coronavirus after all.

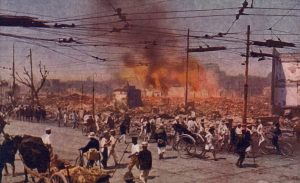

②Ukraine

The tension between the West, centering around the United States and NATO, and Russia is getting tight, and attack or invasion by Russia is becoming a matter of concern. The biggest weak point of the West is that natural gas import from Russia is over 30 %, In particular, natural gas import from Russia is 55% in Germany through pipeline. The United States is struggling against maintenance and strengthening of unity, because each country has difference in attitude towards Russia by their circumstance.

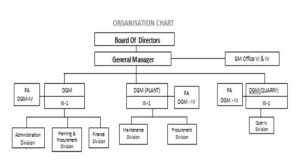

Natural resources are almost imported from overseas in Japan, and depending excessively on countries having different national policy or ideology is a big risk for Japan. The management of private company is the same, and it is important for private company to formulate BCP (Business Continuity Plan) as much as possible as part of crisis management, preparing for matters arising from geopolitical risks, natural disasters, and so on.

On July 16, 1969 when Apollo 11 landed on the moon and the human race got down to the moon for the first time, I was 26 years old. Honestly speaking, I expected that the history of the human race would change by this event. I thought that the world view and view of life of the human race would change and the difference of race and religion and the war or dispute over territory would disappear, by watching the picture from the moon in which ‘tiny but beautiful earth’ is floating in the space. However, nothing has changed unfortunately from 50 years ago till now, and I have a feeling that the human race may be ‘foolish creature’.

③Inflation (The rise of consumer price index=CPI)

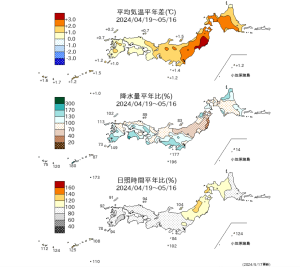

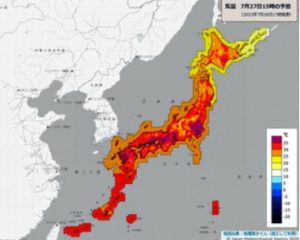

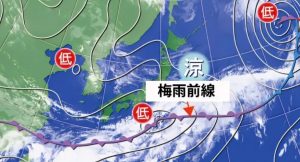

Recently, a word named inflation is flying around globally, and in the leading industrialized nations such as the United States, Europe and so on CPI is rising more than assumption (In the United States high inflation rate after an interval of about 40 years). Under such circumstances, monetary policy is going to shift from easing to tightening. As a background, several factors are pointed out. These are increase of demand by increase of government spending for the purpose of coronavirus countermeasure, steep rise in prices of oil and natural gas by geopolitical risks, rise of resource prices such as iron ore and coal by various reasons, and steep rise in prices of food such as wheat, corn and so on by climate change. In addition to these factors, supply bottleneck like clogging of supply chain by expanding infection of new coronavirus is taken place.

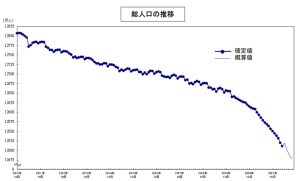

In case of Japan, weak yen is added to this circumstance. And from April, pushing down factor by a cut in price of mobile bill will go out of sight. Therefore, it is expected that CPI will go up to the level of 2 %, and changing over from ‘deflation’ to ‘inflation’ is more likely. On the other hand, low economic growth is still continuing in Japan, and enterprisers can’t take their eyes away from financial and monetary policy, foreign exchange rate, the trend of wage increase and personal consumption, and so on.