Re: What I think about through recent news May 27, 2022

I would like to take up recent news which I am interested in and comment what I think about.

■Ukraine

Three months have passed since Russia invaded Ukraine. President Putin had thought that the invasion would be brought to an end for several days, but things did not turn out the way he wanted, and the view that this war will be prolonged is spreading now. When I watched exclusive interview with President Zelenskyy by NHK in the morning on May 25, I keenly felt that he would “protect his country” with his “strong determination and resolution”. And his appearance that he inspects the front lines regardless of his own safety in other news program is convincing more than any words. In any case, I admired his strong power of communication.

His appearance that he does not keep a manuscript close at hand, and appeals for peace turning his eyes straight on the camera at various country’s national assemblies or international congresses in fluent English, adding some episodes occasionally, is emotional. And in spite of severe wartime, he does not show any sign of fatigue and there is room for his talk. On top of this, he has a thorough knowledge of recent international situation including the trend of China and so on. I was so surprised.

On the other hand, I hear voices like “the United States abandoned Afghanistan”, but in the case of Afghanistan, its President quickly escaped his country. In other words, he abandoned his country and “ran away”. Neither a people nor soldiers can follow with this sort of the leader’s performance. Even the United States can’t help but think that it is useless to help the country that “has no spirit to defend itself on its own”. How the leader should be on the verge of a crisis. I think that there are many things the company’s top management needs to learn.

■The trend of global economy

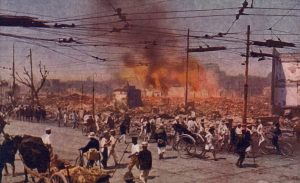

In the stock market of the United States, there is a witty remark “Sell in May”. In the market, the stocks were sold in accordance with this saying, and stock prices dropped $930 in a week till May 20, and dropped about $3600 just over 10% for eight weeks in total so far. It is said that this drop is for the first time in 90 years since 1932, the Great Depression. An impression of relatively expensive centered around high-tech stocks is amending. It is pointed out that one of the reasons is turning to a restrictive monetary policy by U.S. Government.

The U.S. Government has already shifted its policy to contain inflation and raised the interest rate. Europe is also considering the same direction. In China and Japan, there is an anxiety about the present situation of domestic economy. They keep a low-interest rate policy, and the depreciation of their currency is occurring. In the world economy, concerns of stagflation, a situation in which the inflation rate is high and the economic growth rate slows, is coming out, and we can’t afford to become optimistic about the future economic outlook.

■The decreasing share of free nations and a setback of globalization

In the power map by Freedom House, a non-profit organization in the United States, in which multiplying grouping of degrees of freedom (“free” “partly free” and “not free”) of each nation’s politics and GDP, the share of free nations has been lower from 86% in 2000 to 64% in 2020. On the other hand, the share of not free nations is expanding due to the rise of China and Russia.

In addition, globalization in the sense that people and goods can freely come and go in the world met with a setback due to the violence by Russia this time. It seems to need several decades until the airplanes can fly freely over Siberia as before. The companies also need to review their overseas strategy.

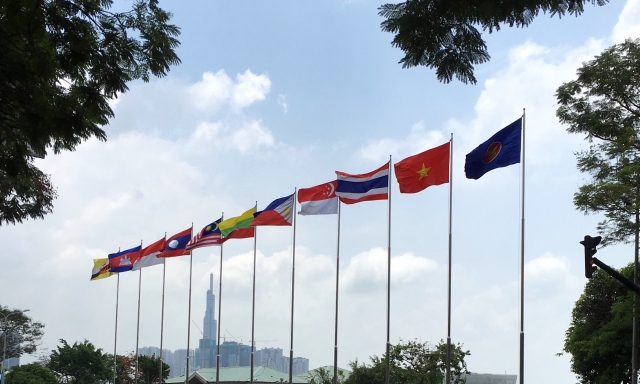

■Which country is the most influential to ASEAN ?

According to the Nikkei on May 22, 2022, when ISEAS, a think tank in Singapore started the survey in 2019, conducts an awareness survey about “the most economic influential country” toward intellects in ASEAN countries, a ratio of respondents answered “Japan” has decreased from 6.2% in 2019 to 2.6% in 2022, and is far behind China, 77% at the top. On the trade side, in the value of trade against ASEAN from 2003 to 2021, Japan used to complete for the top spot with the United States until 2008. But in 2009, China overtook Japan, and the difference is nearly three times in 2021. And Japan was nearly three times as big as Korea in 2003, and Korea is imminent, 1.7 times as small as Japan now. Japan had invested aggressively in ASEAN from late 1980s to early 1990s, but the presence of Japan in Southeast Asia is recently becoming weak more than we think.

(P.S.) I went up to Tokyo this week for the first time in a while. Both reservation and payment of a train is done by my smartphone, and I can just hold my phone over the automatic ticket checker as I get on or off a train. When I go up and down the escalator, I stand on the right, and others stand on the left. I realized “Ah, I am in Tokyo now”. And when I get on a taxi, I input my phone number into navigation system, and the taxi starts once confirmed the number. I can just insert my card in payment and get the receipt. Reservation, payment and issuing a receipt of hotel is done by a smartphone. I realize the convenience of digitalization, but on the other hand I feel a little uneasy that everything is not visual, and “something like dry desert” or inhumanity. I wonder if longing for the analog age is outdated or not.

In addition, before a smartphone comes into existence, we somehow tried to remember the telephone number, address, and so forth. But now, “we are not trying to remember because we don’t need to remember”. If this goes on, “memorization power” which is a superior ability of human beings is degenerating rapidly. And I fear though it may not be necessary that we may suddenly become something like a “slough”, once a smartphone disappears from our hands.