Re: A news item and subject which I just want to check out (66) November 4, 2022

It has been November from this week. We have only two months left this year. The days are rapidly gone by. A commentator of NHK’s late-night show says “this day that we call today will not come back a second time” and that is true for sure. I want to spend each day as meaningful and healthy as possible.

I picked up a news item and happening which I want to check out this week, too.

■■My business partners from previous job came to Osaka from India:

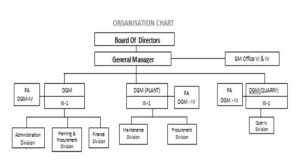

■There was a joint venture in India before, and its main business was rail transport of cars produced at Gurgaon factory near New Delhi. This joint venture is still expanding its business. In India, there is a problem with transportation quality due to bad road maintenance situation, and there is a movement to convert from trucking to rail transport. In April 2017, the opening ceremony of the joint venture was held. At that time, I received heartfelt hospitality like letting the tailor make an Indian traditional formal dress adapted my dimensions.

Two sons of the owner of joint venture company came to Osaka this time.

And after I thought a lot about inviting them to lunch, I guided them to “conveyor belt sushi” at Umeda. Indians don’t eat beef for religious (Hindu) reasons. There are many vegetarians in India, but they seem to like sushi. When I invite foreigners to dine, I try to choose a place or restaurant, where they can get in touch with Japanese culture, climate and customs, trend, rather than an expensive restaurant. This time I had confirmed that “they like sushi” beforehand, and then I chose the conveyor belt sushi fully embraced the currently popular digital. I went to the restaurant to check its system in advance. It is to import restaurant menus to my smartphone with a QR code and order each in the English version provided. I thought that this pleased foreigners because this was very new for them.

■I have been to India five times. My first visit was about 50 years ago. Indian people are very tough to do business, especially when it comes to negotiations. About people who leave the country of birth, establish roots in a foreign country, and engage in business, we call “overseas Chinese” for Chinese people, “overseas Vietnamese” for Vietnamese people, and “overseas Indian” for Indian people, incidentally “overseas Japanese” for Japanese people. Among them, according to my impression, I feel “overseas Indian” is the toughest and stubborn. In any case, in order to start and get your business on track overseas, how to find and make good use of humanly superior and trustworthy local people is the key point. In order to do that, connoisseur power is necessary. And it is important to promote localization as much as possible.

■India shares a border with China over 3,380Km, and with Pakistan over 3,323Km. And India also shares a long border with Bangladesh and has detached territories. Different from Japan surrounded by the sea, it seems to me that geopolitical complexity fosters tough diplomatic ability in India. In particular, at the border with China and Pakistan, tension continues and India needs to prepare for defense. Therefore, the military spending to GDP ratio reaches 2.88% (In Japan, it is 1% so far). And on the diplomatic front, it has an “omnidirectional foreign policy”, and a policy centered on the national interest like composing BRICS (Brazil, Russia, India, China, and South Africa), and at the same time joining QUAD (Quadrilateral Security Dialogue). It judges various agreements and voting on its own merit, and does not make the flag clear. And on the economic front, about 80% of oil is imported, and then it has an impact on foreign policy in no small way.

■In domestic affairs, India is known as “ the largest democratic country in the world”. For that reason, Indian politicians pay attention to election, and it is the same in Japan and it is difficult to give “bitter medicine” to the public, and a reform of old regulations is delayed. Recently, there is relaxation of dismissal regulations of small and medium-sized companies which is a special-feature of labor legislation reform. Even if it is passed by Congress, it is not enforced. Even so, based on the prospect that population will be over 1.6 billion in 2050, according to aggregate results of the United Nations and increase by 1.2 times compared to 2022, due to expectations for future growth, high-tech companies and venture capital are actively expanding into India.

≪P.S.≫ Succeeding Prime Minister Truss in the United Kingdom who announced her resignation after only 44 days in office, former Minister of Finance Sunak has taken office. He is the first Prime Minister of Asian descent (Indian descent immigrated from Africa).

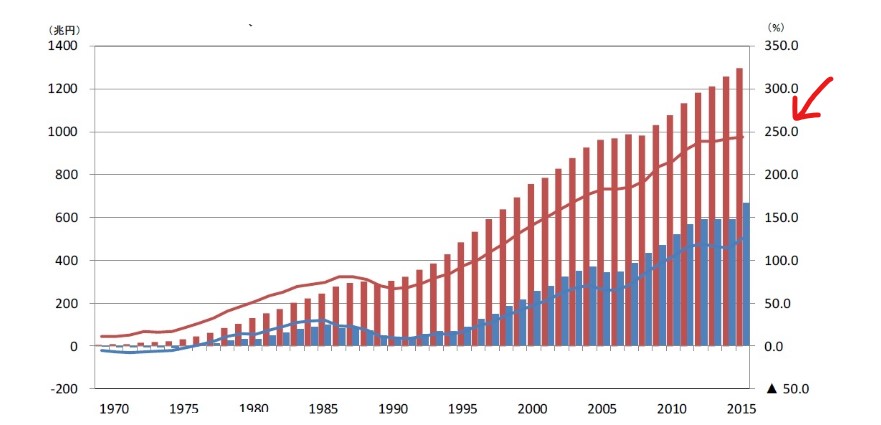

The reason why Prime Minister Truss was forced to resign was that massive fiscal expansion policies were evaluated as pork-barreling in the market, and government bond prices dropped suddenly, in other words, interest rates on government bonds skyrocketed. Incidentally, a debt to GDP ratio in the United Kingdom is 108.5% in 2021. On the other hand, the total debt obligations of central and local governments in Japan exceed 1,200 trillion yen, and a debt to GDP ratio is 263%. On top of that, the Bank of Japan stubbornly continues monetary easing and a low interest rate policy, and makes the depreciation of the yen accelerate, and Japanese government supplements soaring raw material prices due to this with subsidies, and finances the subsidies by issuing government bonds, and the Bank of Japan buys up the bonds. It’s a composition of leaning each other. The problem is that current money is managed currency and not supported by “gold” just like in the old days, and supported only by trust and confidence to the country and government issuing currency. Once it is lost for some reason, government bond prices drop suddenly, and currency loses value. The reason why we are preventing such situation at the moment is that possession rate of government bonds by foreigners is about 13% and low, and the Bank of Japan holds the majority of government bonds issued.

In spite of such dangerous situation, both Japanese government and people have less sense of crisis, and Japanese government continues pork-barreling as ever and increases debt to the next generation. Moreover, it is not even linked to structural reform and constitutional improvement of Japanese economy and companies. I wonder if we should learn something from the fact that fiscal anxiety led to political change in the United Kingdom this time and have to think seriously about national finances.