Re: A news item and subject which I just want to check out (152) September 27, 2024

Sekiwake Onosato aged 24 had a record of 13 wins and 2 losses and achieved a second Makuuchi division victory at the Autumn Grand Sumo Tournament. And the fastest promotion to Ozeki, 9 tournaments since debut and 5 tournaments since first entering the top division, has been decided since the Showa period. He was born in Tsubata-machi, Kahoku-gun, Ishikawa prefecture, and belongs to Nishonoseki-beya where the Master is former Yokozuna Kisenosato. He is 192 cm and 182 kg and has a blessed physique. When I watch his match, I feel a great potential in rushing forward more and more and sense of speed. If he “trains with a three-year vision in mind” that the Master says in this condition, I feel like the promotion to Yokozuna will also be a record-breaking. The disaster such as earthquake and heavy rain has continued in Ishikawa prefecture recently, but for the first time in a long time, it was a great achievement to uplift the spirits of the local people. On the other hand, former Ozeki Takakeisho, a local sumo wrestler from the Kansai region, has retired halfway through his ambitions, and I felt a sense of loneliness.

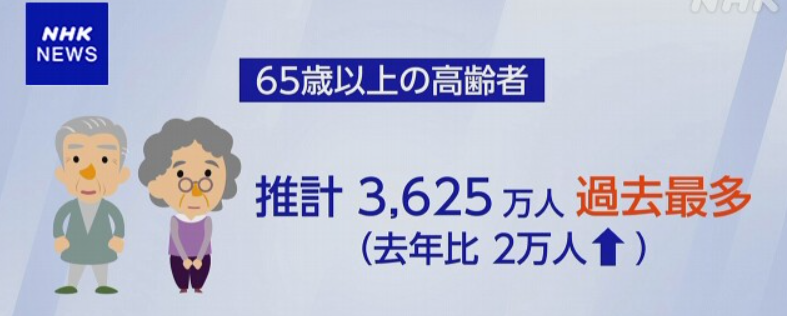

Then, according to a population estimate published by the Ministry of Internal Affairs and Communications, the number of people older than 65 years was 36.25 million increased by 0.02 million compared to the previous year as of September 15 (respect for the aged day), and the percentage of total population was 29.3 % increased by 0.2 points compared to the previous year and both figures were highest ever. The male ratio was 26.1 % and female ratio was 32.3 %. According to an estimate by the United Nations, the percentage of elderly people in Japan is the highest among 200 countries and regions with populations over 0.1 million in the world, and in major countries, Italy is 24.6 % and Germany is 23.2 % and Japan is protruding. By the way, one out of four elderly people are working and urgent review of social security where institutional fatigue is becoming apparent such as annual income barrier, pension and so on is necessary.

■■What I have recently thought and focused on:

■The presidential election in the United States:

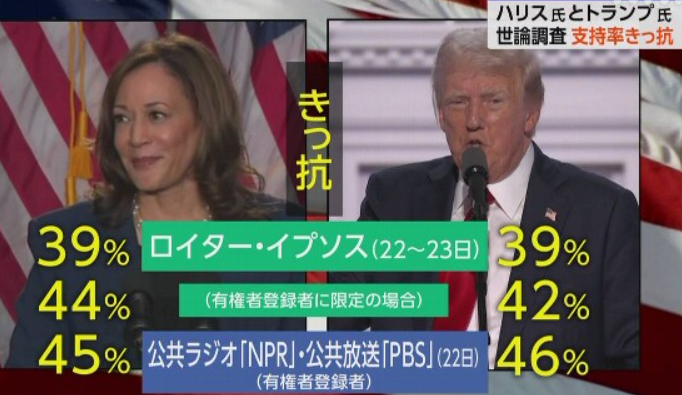

According to various opinion polls, support for Harris seems to exceed that for Trump, especially among young people. The problem is that the voting rate among young people is low in the United States the same as in Japan, and to what extent popularity will be tied up with actual voting behavior. By the way, I feel many times that recent actions and words by Trump are incoherent. On the other hand, he has various court cases and if he loses the presidential election and conviction comes down, he may lose everything and be erased from society. Therefore, he will use every means possible to seek re-election. Even so, if a person without such dignity happens to re-elect the President, what will happen to the United States and the world? Just the thought of it makes me shiver. I believe the American people’s common sense of democracy.

By the way, as far as M&A of U.S. Steel by Nippon Steel is concerned, a private deal turned into a political issue because of opposition of the labor union (USW), and it has led to a situation that could affect the outcome of presidential election. Therefore, President Biden did not come to a conclusion and it needs to reapply after the election. The conclusion depends on which candidate wins the presidential election, but if returning from political issues to private business basis, I think there will be a possibility. But I have an impression that Nippon Steel side is presenting a personnel proposal and investment projects that fully accommodate demands by acquired company side, and I am concerned about that it can mend the strained relationship with the labor union. The so-called PMI (Post Merger Integration) maximizing the effects of mergers and acquisitions is a matter of what happens.

■The Liberal Democratic Party’s presidential election:

New president will not be decided yet at a time when this blog streams, but it seems that none of the candidates can secure a majority in the first round of voting and going to a runoff between the top two candidates is a definite situation. In that case, it will be Ishiba vs. Takaichi, Ishiba vs. Koizumi or Koizumi vs. Takaichi. I made a statement as my opinion at the usual lunchtime seminar hosted by Mr. Fumiya Shinohara, political commentator, the day before yesterday that “it seems to me that the poll of local assembly members (party members and fellow party members) better reflects public opinion. But voting criteria for members of parliaments depends on who they vote for to receive preferential treatment in cabinet appointments or gaining an advantage in the next election rather than political skills and furthermore, it is influenced by factional logic, even if the faction has been dissolved. It’s a pity and I suggest system allowing for election of the prime minister by popular vote. That is how the faction will disappear”. According to Mr. Shinohara, this system was once considered but it needs the constitutional amendment and then it faded away all at once. In any case, the current situation in Japan is not an easy situation like choosing based on populism, and I hope a person who has a firm political skill, principle and world-view steps up.

■What was disputed at the presidential election:

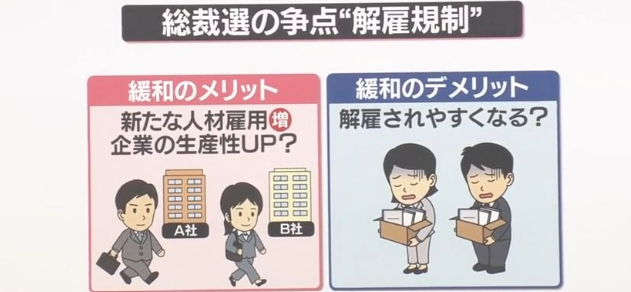

①”Easing dismissal regulations”:

Dismissals “lacking objectively reasonable grounds” are considered invalid in Labor Contract Act. It is natural. But proving this is not easy and trials tend to be prolonged. My principle and claim regarding this matter are as follows.

≪Labor protection policy by subsidies and so on in Japan seemingly helps workers but as a matter of fact, it’s just a temporary measure like “a gel-filled sheet” and reduces the independence of not only workers but also companies, especially small and medium-sized enterprises, and they are stuck in a constitution where they can’t get out of “relying on their superiors” or “public-private partnership” forever. And it is contrary to the reality in the United States and you can say that it deprives them of the opportunity to increase their income by improving skills. And the government praises itself that the unemployment rate is low in Japan, but the subsidies for employment adjustment and so on lead to increase in-house unemployment, reduced productivity and morale, slowing down the culling, reorganization and integration of companies, saving and increasing zombi companies and decline in national power. Our country suffering from a constant labor shortage should ease corporate dismissal regulations or make them more flexible, and facilitate the transition of the workforce from declining industries to new industries. Of course, needless to say, the promotion of such policies requires the establishment of a supportive environment such as fostering and strengthening the dynamism of the labor market, reskilling support, abolition of the retirement benefit system based on the premise of lifetime employment, early retirement program not disadvantageous for job changers and so on≫.

②Fiscal discipline and soundness:

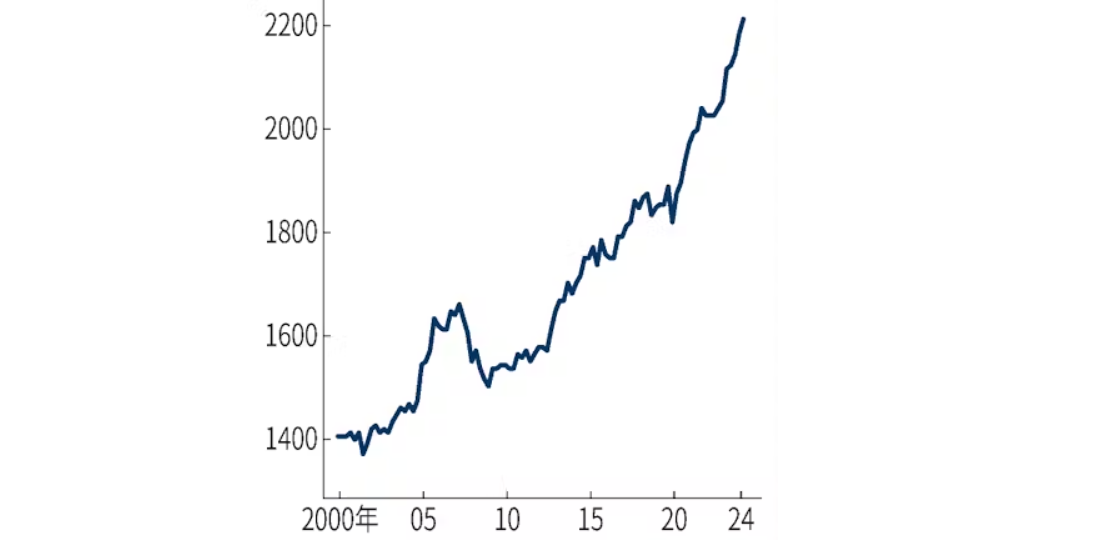

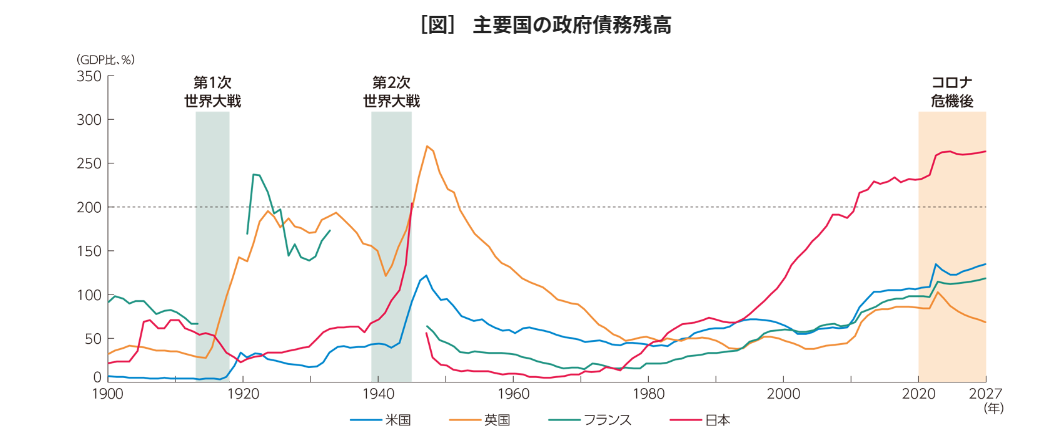

In Japan, there are the so-called reflationists that financial assets held by individuals are 2,212 trillion yen at the end of June this year and the current national and local fiscal deficits are not a problem. Abenomics was also based on such idea. But in Japan, there has been a saying that “measure what comes in and control what goes out” from old days. And financial deterioration affects government bond rating and exchange rate (weak yen), because yen is not a key currency like dollar. And the people are anxious about the future and then the reality is that financial assets held mainly by elderly persons stay as savings and are difficult to connect with effective demand. Regarding fiscal situation in Japan, there were interesting opinions by IMF.

◎According to total debt combined commonly-used national and local debt with social insurance funds to GDP ratio, Japan’s debt-to-GDP ratio is over 250 % and the worst in 178 countries and regions.

◎According to “net assets” considering assets and liabilities to GDP ratio, Japan’s ratio is about 9 % asset excess and second after Canada in terms of soundness in G7. This is the basis for the claim of reflationsists. However, the reason why this number is at the top is that the level of public fixed assets holdings such as road and harbor is higher compared to major advanced countries. Such assets have low liquidity and there is a liquidity problem, and in case of companies, they might end up in a situation like a surplus bankruptcy.

◎According to “net assets” excluding financial assets that liquidity is low to GDP ratio, Japan is over 150 % in 2022 and the worst in 89 countries and regions.

To sum up the above points, public investment has focused on the construction of “the buildings” in Japan since the bubble economy burst, as if to be ridiculed that “a fishing pond worth 10 billion yen” in harbor maintenance and roads built by political power “are used only by raccoon dogs and wild beers”. The result is accumulation of debt exceeding 2.5 times the GDP now. And looking at the recent disaster situation, I think that the construction under the name of preventing disaster is not very effective. After all, humans are not fighting against nature, but we should respect the power of nature and prioritize living harmony with it. By the way, in spite of huge investments, annual average economic growth rate over the past 30 years in Japan is less than 1 % (0.7 % from 1990 to 2021) and is performing poorly. The reason is that there has been no investment in software (human resources, research and development and education) to make the most of the hardware we have built. As a result, I think that it did not lead to the creation of new industries (IT and so on) or an increase in productivity.