Re: A news item and subject which I just want to check out (167) May 2, 2025

The State of California of the United States announced the other day that California’s nominal GDP in 2024 was $4.1 trillion (about 585 trillion yen) increased by 6%, surpassing Japan’s GDP of $4.02 trillion, and has become the fourth largest in the world after the United States, China, and Germany. It seems that the increase in tourism revenue and contributions from the high-tech industry have had a significant impact. The population of California is 39.43 million in 2024, just slightly above the total population of one metropolis and three prefectures in Kanto (Tokyo, Kanagawa, Saitama, and Chiba), about 36.94 million. But the size of GDP in California is about three times as large as that of 192 trillion yen in one metropolis and three prefectures in Kanto. Where does the difference of economic strength and productivity arise from? Hollywood is located in Los Angeles, the biggest city in California, and in the suburbs, there are Universal Studio and Disneyland, but there are no casinos. Los Angeles is enhancing and strengthening logistic functions such as ports and airports as a gateway of the West Coast of the United States and is attracting investment from both domestic and international sources, and its economy continues to develop. Osaka, which has many similarities, should not overly depend on events, but instead take California as a model for its industrial policy.

■■What I have recently thought and focused on:

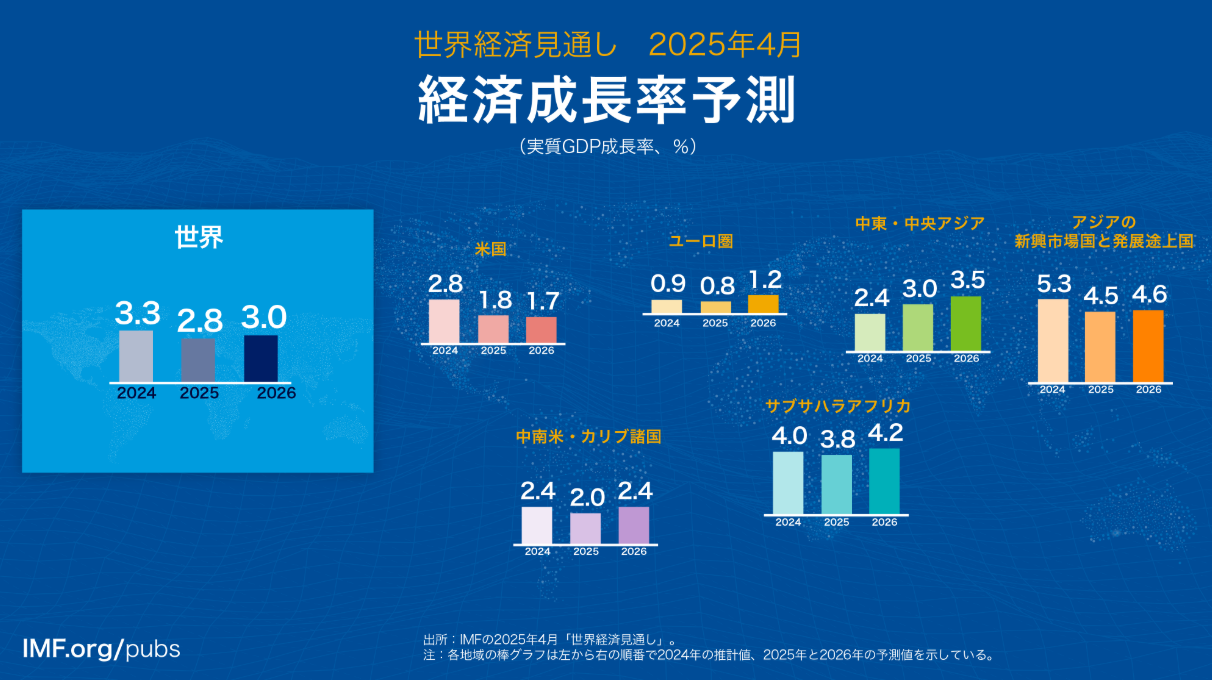

■The global economic outlook:

The International Monetary Fund, IMF, has projected the global economic growth rate in 2025 to be 2.8%, lowered 0.5 points from the previous forecast in January this year. IMF anticipates the effects of high tariff policy by President Trump, and all countries and regions are downgraded, leading to a complete collapse. The United States itself is also in a position to be splattered with blood, and preliminary real GDP from January to March this year has decreased by 0.3% on an annual basis. It forecasts that the growth rate in the United States in 2025 will be 1.8%, a downward of 0.9 points, a sharp slowdown from 2.8% in 2024. President Trump claims that the economic slowdown is “a short transition period” and shows a bullish attitude, but IMF forecasts that the U.S. economy in 2026 is expected to grow by 1.7%, lowered 0.4 points from the previous forecast. It gives a warning that if “supply chain” and flow of funds collapse, these become a cause of significant economic turmoil. Incidentally, it forecasts that Japan will be a low growth rate of 0.6 % in 2025, lowered 0.5 points from the previous forecast. It mentions that the factor for the downward revision is the suppression of exports, due to 25% sector-specific tariff on automobiles.

On the other hand, according to the latest trade forecast by the World Trade Organization, WTO, the trade volume of goods in 2025 will decrease by 0.2% compared to the previous year, marking the first decline in two years. It is a significant downward revision of 3.2 points from the previous forecast in October last year.

■The tariff issue of President Trump and China’s countermeasures:

IMF forecasts that China’s growth rate in 2025 will be 4.9%, lowered 0.6 points from the previous forecast. U.S.-China business is being manipulated by the tariff policy of Trump administration which is changeable as a weathercock. Trump administration revised the additional tariffs on China, which was announced to stand at “a total of 125%” on April 9, to “a total of 145%” on April 10. Trump administration attitude changing orders from morning to evening is confusing the industry. It was announced that the additional portion of the reciprocal tariffs for some countries and regions would be suspended with the deadline (for 90 days), 13 hours after their activation on April 10.

At present, in China, real estate industry that is considered to account for about 30% of GDP is still struggling in a recession. And due to high unemployment rate among young people and budget-minded consumers, the economy is sluggish in general. It has achieved a growth of 5.4% from January to March this year, due to the increase of last-minute exports before the tariff increase. But after April, exports to the United States will effectively come to a halt, due to the backlash from the rush demand and implementation of high tariffs by the United States. On top of that, this time, Vietnam, Thailand, and Cambodia are subject to reciprocal tariffs at the same time, and then conventional diversion exports will also become difficult. That is why it is considered that the Chinese economy will be pushed into a difficult situation in the future.

However, there is no way China would “ask for leniency” regarding implementation of high tariffs by the United States. Actually, China insists that “if the United States imposes a tariff increase, China will go with it in every respect”. And China is taking countermeasures such as switching the import of agricultural products from the United States to other countries and export controls of rare metal, weaknesses of the United States. China is gradually reducing its holdings of US Treasury bonds and is increasing its gold reserves instead. At the same time, China is advancing the deepening of economic and diplomatic relations with neighboring countries and Global South that are confused by the tariffs of the United States, and is making some progress.

By the way, when I visited Beijing as a member of visit to China mission of Association for the Promotion of International Trade in December 1988 (the year before Tiananmen Square Incident, at that time I was 46 years old), I had the opportunity to meet President Deng Xiaoping at that time and hear him speak up close. What stands out to me most is that he said “Today, the number of people in my country who find it difficult to eat is only 60 million”. He mentioned this as an indicator showing China’s remarkable economic development, and this number is about half of Japan’s total population. But considering China’s total population of about 1.2 billion, this number is about 5% of the total, in other words, one in twenty people. Considering the situation of China at that time, it was a convincing number. Since then, I realized that China needs to be viewed through a different lens.

The underlining strategy of the policy of present Chinese Communist party is to adopt a protracted war based on “People’s War Theory” of the late President Mao Tse-Tung, founding father. Even in case of this tariff friction between the United States and China, Chinese Communist Party will not make a one-sided compromise at any cost in order to protect one-party rule. It is possible due to the political system. It seems that lately President Trump side that is pressed for time and anxious is rather struggling to find some kind of breakthrough. Incidentally, it seems to me that he is good at attacking or verbal attacks, but weak against counter punches or counterattacks. The tariff policies of President Trump carry the risk of ending in diplomatic mistakes of the United States.

■What has happened to a virtuous circle of prices and wages?:

The rise in prices continues. According to Ministry of Internal Affairs and Communications, the consumer price index in 2024, total excluding fresh food, increased by 2.7% compared to the previous year, exceeding 2% for three consecutive years. The main factor driving the overall increase is groceries, increased by 5.0% compared to the previous year. The inflation rate in the Tokyo metropolitan area in April increased by 3.4% from the same month the year before, and has reached the 3% level for the first time in 21 months. The rising prices of groceries, particularly rice, have become especially noticeable.

By the way, according to Teikoku Databank, items with price increases were about 32,000 in 2023 and in 2024, have decreased to about 13,000, but this year, it is possible to reach 20,000 items. On the other hand, wage increases have continued at a high level for two consecutive years in 2023 and 2024, and compensation of employees from July to September 2024 increased by 6.1% compared to two years ago, and nominal wages increased by 6.7%. But social insurance premiums increased by 6.8%, exceeding income growth. In other words, the wage increases are being offset by social insurance premiums. As the aging population continues to progress, an increase in social insurance premiums is unavoidable. On the other hand, as the election approaches, shelving the issue of funding, the debate over handouts such as tax reduction and subsidy takes on a life of its own. Monetary policy is also trending towards interest rate cuts globally, but Japan is being pressured to raise interest rates due to rising prices. However, the Bank of Japan is unable to raise interest rates due to an effect of tariff issue and concerns regarding the drop in government bond prices. How will Japan proceed in the future, combined with postponing difficult issues in politics?