Re: What I think about through recent news (54) July 29, 2022

Following the last week, I comment what I think about, when I hear and see recent news.

■The infected people by coronavirus exceed 200 thousand: “The seventh wave” of expansion of new coronavirus infection has spread like wildfire, and the number of new infections per day reached 230 thousand, and in the end, became the most in the world. I feel like “why?”, because Japan has been implementing the most severe airport security measures, and almost 100 % Japanese are carrying out mask wearing consistently, the vaccination rate in Japan is exceeding the world standard, and limiting the number of people in a meeting has been implementing. Two and a half years have passed since the infection of coronavirus began, and at the beginning, we had reacted well against a few infected persons, but now we are getting used to it and we don’t feel much tension. Due to this, it may lead to “a gap” the coronavirus imposes on.

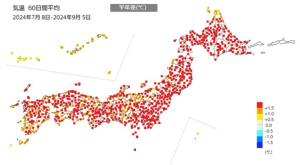

And in addition of coronavirus, caution towards heatstroke associated with extreme heat is also necessary. And a new plague such as a monkeypox has occurred even in Japan. This is a side effect of globalization, and the incident occurred at the end of the world is coming nearer and nearer in no time.

■Grain exports from Ukraine:

This kind of “getting used to it” is similar for Russian’s military invasion to Ukraine. Five months have passed since the invasion, and the battle situation is at a deadlock, and a massacre is taking place every day. About this, when we are watching the similar pictures every day, we have lost our special emotion. “Getting used to it” is really scary. By the way, we can foresee restart of grain exports from Ukraine stopped by the military invasion, through the intermediation of Turkey and the United Nations. A clogged supply chain something like there are “goods” but goods can’t be transported has happened up to now. By doing this, a risk of starving to death in Africa and the Near and Middle East will be likely to be relaxed.

■Global economic developments:

It is likely that the global economy is heading into a recession. It is difficult to predict how serious it will be, because there are so many uncertainties. Rising resource prices such as a crude oil have occurred for a long time, but due to the occurrence of Ukraine’s problem, inflation has ignited. As a result, countries all over the world except Japan are moving to raise interest rates simultaneously. An average rate hike in developed countries is 1.7%, and an average rate hike in emerging countries is 3%.

In the United States, consumer price index increased by 9.1% compared to the previous month, and broke a record for the first time in about 40 years. Therefore, FRB decided 0.75% increase following the previous month on July 27. But GDP for April – June was negative 0.9%, and the economy recorded negative growth for two consecutive quarters. FRB clears up its policy that FRB puts the priority on controlling inflation even if sacrificing the economy. And stock prices are rising in the United States, and this means that an expectation called “inflation will be settled in a short period of time” is anticipated.

By the way, about 40 years ago I lived in New York. The second oil crisis originally started owing to Iranian Revolution in 1979 led to inflation in the United States, and there was not only spike in gas prices but also uncertainty of gas supply. Therefore, all over the United States became like a panic. And you may not believe it, but market interest rates reached 20 % in 1981, and I still remember it as trauma. I think that it will be not so extreme this time. However, in addition to rising interest rates, there are a lot of factors negatively affecting the economy and business activities such as slow down of Chinese economy, a setback of globalization and so on. As a matter of course, such external factors have a significant impact on Japanese economy too.

■The economy in Japan:

Japanese government predicted that real growth rate of GDP in 2022 was revised downward from 3.2 % on a year-on-year basis predicted in January to 2.0 %. Incidentally, only Japan has not raised interest rates among major countries in the world. This is because Japan can’t break free of deflation, but consumer price has exceeded 2%. Depreciation of yen leads to price increase. However, increase of visitors to Japan anticipating as a merit of a weak yen does not turn into a reality. As far as corporate performance is concerned, there are types of industry benefiting from a weak yen, but small businesses which account for 99 % of total business operators and 70% of employed workers, especially service industry, are in a sever condition.

(P.S.) In a logistic industry newspaper called cargo news published on July 28, I wrote about 3,400 characters entitled “Truck transportation business operators must find a means of survival for themselves”. I wrote my private opinion based on my experience related to truck transportation business for a long time. Trucking is undertaking a role of “life line supporting lifestyles and the economy”, but 99 % of total business operators consist of micro, small and medium-sized enterprises, and trucking is in a severe condition in terms of management. In order to improve this situation, “structural reform” is necessary. I think I want to publish in this blog in the near future. I should be very happy if you would read it and give me your opinion and criticism.